Can I just say that I hate contractors?

Can I just say that I hate contractors?

Seriously, is there a reputable contractor in existence? It’s really frustrating.

Over the past couple of years, we’ve done some pretty major renovations to our home. Back in December of 2006, we had our roof done. The original roof had two layers of the asphalt shingles and these were on top of a layer of cedar shingles which were likely original to our 100+ year old house.

Basically, it was a pretty big job simply because of all of the stuff that had to be removed and all of the additional material, like plywood, that had to be added before the re-roof even started. Total bill was around $14k.

It started off great, a HUGE dumpster was delivered and dropped right in our yard and work began. After a few days though, it was as though the dumpster was an afterthought. They were just letting the debris slide off the end of the roof. I can understand that — it would be a lot easier, but they dumped probably half of the roof onto decorative shrubs right in the front of our house?!

It got worse though. I didn’t mind that the debris had ripped probably 80% of the screens in our windows, whatever, but one evening I came home and found the window on our detached garage (which was not being worked on) was broken.

I went in, and noticed some finger dust marks (the car was in storage for the winter and it gets pretty dusty) over a deep scratch on the hood of my BMW?! No broken glass anywhere on the floor. Very odd. My wife and I went all CSI and came to the conclusion that they somehow managed to throw a brick from the chimney on the roof, through the window of my garage.

From there, they went into the garage, probably crapped their pants when they saw the car it hit, and they tried to clean up the evidence. I wanted to barf. Profanity was used.

I was upset about the car. I was upset they went into my garage. I was upset that they tried to cover it up. I was upset that they killed my bushes. While the did a nice job on the roof, in the grand scheme, I wasn’t at all happy with the contractors.

Making matters worse, the dumpster remained in our yard for an additional 3 weeks — on Christmas Day, yes, we had a 40 cubic yard dumpster along side our house. It was very festive. Adding insult to injury, the construction company was stopping by a couple of times a day, driving right up on our lawn, and dumping more into it.

Sure, the neighbors probably thought we were also having our kitchen remodeled, based on the additional debris from other projects piled high above the walls of the dumpster, but in actuality, we were just the contractor’s personal landfill.

The next project was the siding project that I detailed on the site last summer. The contractor we selected had a seedy sales team, you know, were the one guy just goes on and on and on about how beautiful your wife is (while it’s obvious he’s just a dirty pig), and how she’ll love this color siding (I hope so, she picked it…), and how he was a star baseball player for the Red Sox back in the day. I looked him up. He wasn’t. Besides, I hate baseball. Nice try there, bro.

Anyway, the cost of that project was over $26k. It was supposed to take 2 weeks to complete and work began on June 14 — two weeks earlier than it was supposed to.

Things looked good — everyone was happy. And then it took a turn for the worse. They ordered the wrong window for our attic. They put another window in the wrong place. They lost an employee so they couldn’t do any work. They put the wrong header on the front window of our house. They started begging us for more money?!?!

Then the siding on one section of the house wasn’t level — and it was obvious. They put the handles on incorrectly on our front door — and the locks didn’t really work. They even chipped a piece off of the trim on the new front door. They called it a thousand dollar door — though at Home Depot, they run around $300. Either way, they didn’t hang our door correctly.

At that point I just wanted them out of our house, I didn’t care. I’d go out and buy another $1000 door just to make them go away.

In the end, the project was finally completed in October. Hardly a 2-week project. It was a 5 months of hell. Just thinking about it makes me angry.

Making matters worse, have you ever found it funny how all contractors like to take pride in how they clean up after themselves? This specific contractor still highlights that “feature” it in their ads in the weekly paper. Hmmmm… my yard still has 100’s of cigarette butts that I’m still picking up, not to mention thousands and thousands of nails that my lawnmower will surely choke on this year.

Roofing shingle fragments are everywhere, vinyl slivers, styrofoam insulation pebbles, just crap everywhere. And did I mention all of the indentations in the lawn from all of their driving around they did in our yard? No, I probably didn’t. They ruined our yard. Then littered all over it.

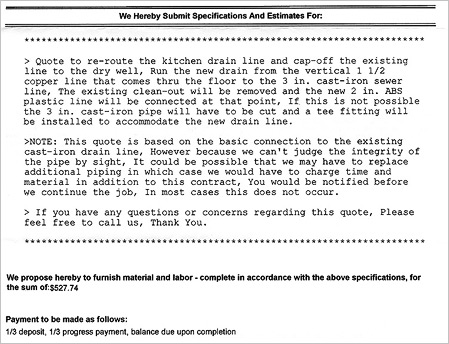

So what makes me bring all of this up today? Well, remember that basement plumbing problem I mentioned last week? The one where the plumbing company was coming out to give us an estimate on Tuesday?

Well, they came out and said that they call us with the estimate tomorrow. That “tomorrow” was 3 days ago now.

They haven’t called. And our house still smells like sewage.

Can you understand why I hate contractors now (or again)?

You’d think that after spending in excess of $40k on renovations that your house would be better off for it — but in reality, I’m not certain that it is…

So this morning I wrote and mailed the check for June’s mortgage payment.

So this morning I wrote and mailed the check for June’s mortgage payment.

Following the

Following the

Thanks to Treasury Direct’s overly secure login sequence…

Thanks to Treasury Direct’s overly secure login sequence… Can I just say that I hate contractors?

Can I just say that I hate contractors? So last night I went to the IRS website and played with their new “

So last night I went to the IRS website and played with their new “