I suppose it’s time to set and log some goals for 2009…

I suppose it’s time to set and log some goals for 2009…

When I set my goals for 2008 back in December of 2007, I thought they were a little lofty but somehow I managed to tackle every one of them.

The only one still remaining is the $10k in savings, which isn’t likely to happen after my Black Friday episode, but it’s still a possibility, albeit dim.

Even if I don’t manage to achieve that one, I’m still far ahead of where I was at this time last year. Far ahead.

My goals for 2009 aren’t going to be as specific as my goals for 2008 were.

I don’t have any debts worth paying down at an accelerated rate anymore and, while I’m still struggling to get a grip on how to save money more efficiently, I think I’ve made HUGE strides in the past year.

Just having a few months worth of expenses up your sleeve, or in an ING account, really does take a load off of your shoulders. I didn’t think it would, but it did.

So here are my ultra-vague goals for 2009 that will be all but impossible to track throughout the year with colourful side-bar graphs:

1. Find a contractor to gut and remodel the entire first floor of my house. New kitchen, new bathroom, new floors, new walls, and new ceilings throughout.

Preferably, I’d like to have the project nearing completion by May 2009.

2. Pay for all of the work done by the end of the year. Realistically, we’re going to have to find financing for a great deal of the work and, again, I’ll probably use my credit cards for most of it.

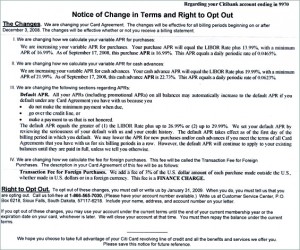

That said, I’ll have to cross my fingers that I don’t receive more “Change of Terms” letters like the one I received from Citibank earlier this week. That would be bad.

So far, we haven’t really done much in regards to these goals.

We’ve briefly researched a few general contractors, two of which I’m all but certain we’ll seek out for quotes when we’re ready to get things started financially, but I can’t, for even a second, claim that we’ve looked very hard or even thought about exactly what we’d like done.

On the financial front, we’re saving like we’ve never saved before while also reading the fine print on every credit card convenience check offer that comes in the mail — just waiting for the right offer and when it comes, we’ll be sure to take full advantage just to have the cash in our hands and readily available.

The 100% credit card financed method has worked in the past so I’ve little doubt that it will work for us again.

So that’s it.

Pretty short list this year but pretty lofty at the same time…

On the bright side, my net worth didn’t drop 5-figures like it did

On the bright side, my net worth didn’t drop 5-figures like it did