Not gonna happen.

Not gonna happen.

I know, I know… It’s pathetic to be giving up on it after just one week but the goal of spending less than $1500 for the entire month isn’t possible anymore.

A couple of annual business expenses that I’d totally forgotten about happen to come due in February.

Further, I just received a bill for roughly $200 from the dentist for a cleaning that I had done in January. Remind me to say “No” to the x-rays next time…

We dropped our dental insurance last year as we we’d been paying out more in premiums for years than our bills would have cost if we’d paid out of pocket.

It’s times like these where it feels like a bad decision but, mathematically, it was sound.

I only wish we could do the same for our medical insurance but that’s a whole other issue…

Combined — plus the routine monthly utility and mortgage expenses — well, I’m going to exceed the $1500 ceiling in no time so here’s the new goal…

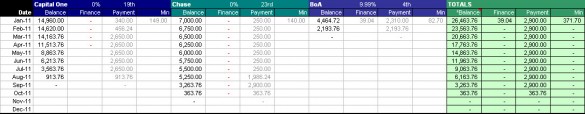

It’s actually a tangent of the original goal — I’d wanted to spent less than $1500 so I could pay down my credit card debt at a more robust pace. Well, the new goal is to have one of the remaining credit card balances paid off by month’s end.

That exceeds the original goal and, yeah, I might need to “borrow” a bit from savings to do it but it’ll be the right move in the long run.

Just like dropping our dental insurance was…

Okay, so it’s not really an ambitious goal since February is the shortest month of the year but I’m going to try to get through it by spending less than $1500 total.

Okay, so it’s not really an ambitious goal since February is the shortest month of the year but I’m going to try to get through it by spending less than $1500 total. Late last week,

Late last week,

Go hard or go home.

Go hard or go home.