I-Bonds – Dodged a Financial Bullet

Thanks to Treasury Direct’s overly secure login sequence…

Thanks to Treasury Direct’s overly secure login sequence…

With a positive cash flow again, I seriously considered throwing some money at I-Bonds again, and with interest rates dropping like a rock, if I jumped the gun before the May 1st, when the fixed rates are adjusted semi-annually, I’d have surely been pulling in a better return than what ING currently offers.

On April 30, I decided to make a move. I logged into my TreasuryDirect account…

Or I tried to…

See, for a couple of years now, they’ve had this “virtual keyboard” login sequence. You have to click all over the place on a randomized keyboard to enter your password. It’s more of a pain than anything else. But a couple of months ago, they took it a step further and mailed everyone an Access Card.

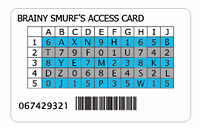

I opened it, looked at it, and put it away. It looked like a Bingo Card. No joke, that’s it up on the right.

So now, in addition to the virtual keyboard, they make you play bingo. Again, with another randomized virtual keyboard.

Could they make logging in any more of a hassle? It’s overkill.

Needless to say, I didn’t have the super secret access card on me, so I couldn’t login. That evening, I thought, “Hey, maybe I can squeak in a last minute transaction before the rates change tomorrow…”

I logged in using my wacky bingo card, set-up a transfer for $1000, a click here, a click there… Things were going pretty smoothly — I didn’t even accidentally hit the “back” button (something you can’t do on their difficult to navigate website)

I was almost done, and feeling pretty good about this wise money move I was making. But then I read the fine print — my transaction wouldn’t go through until May 1st.

That was too late. I cancelled the transaction — and thank goodness for that!

On May 1st, the U.S. Treasury cut the fixed interest rate on I-Bonds all the way down to 0.00%. That’s not a typo. The rate is zero. Nil. Nada. Zip.

I’m sure glad I didn’t accidentally throw $1000 in that direction now — can you imagine being stuck with a 0.00% fixed rate? Now, I realize the real rate is 4.84%, but that’s just the inflation component that changes every six months. While that might sound attractive given that most online banks only offer something in the 3% range, it really isn’t, with the fixed rate at zero, you’re only keeping up with inflation — you’re not gaining anything. On top of it, you can’t get at the money for 12 months.

Not much of a deal there.

In the end, it makes me feel a little better about the little I still have invested in I-Bonds which are currently a rate of 6.27%.

Now *that* was a deal…