Driving Off the Lot in a Used Sub-Compact…

Tonight I stopped by the bank on the way home from work — you know, the drive up ATM…

Tonight I stopped by the bank on the way home from work — you know, the drive up ATM…

Well the car in front of me was one of those beat-up used sub-compacts like in the catchy FREE CREDIT REPORT .COM commercials.

Seriously, it was even the same color.

I didn’t pay them too much attention until they peeled out after completeing their transaction… Real winners, let me tell you.

I mean, the squealing tires immediately solidified their “coolness” in my eyes.

So I pull up to the ATM and their receipt is still in the machine. Now usually when this sort of thing happens at a gas pump or something, I just grab it, crumple it, and tuck it into my pocket.

But due to their obnoxious behaviour, I took at look at the receipt.

Wow.

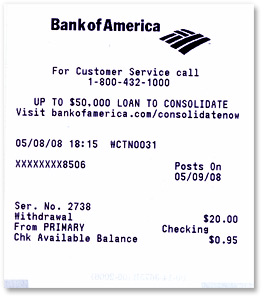

Can you imagine? I had to look at it twice to make sure I was reading it correctly. Yep, 95 cents.

I mean, I’ve run my checking account down pretty low, but never this low.

I also thought it was kinda funny how the little advertisement up top is for “Debt Consolidation”. My receipt advertisements are never for stuff like that — usually it’s BoA’s “Keep the Change” program.

I wonder what the balance threshold is to get the “Debt Consolidation” header… Under $1 perhaps?

Anyway, little things like this make me feel even better about my current financial standing.