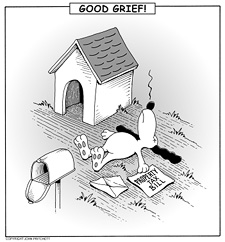

Personal Property Taxes Are (were?) Due

Well, it’s that time of year again. Yep — tax time.

Well, it’s that time of year again. Yep — tax time.

That is, if you live in one of the states that has a personal property tax.

Here in Connecticut, we have to pay local property taxes on our automobiles. We used to be pretty unique in that respect but now roughly half of the country has a similar tax.

Each year, the personal property tax is due on July 1st. The city mailed the bills out on July 3rd.

So, by the time we received the bill, after the Independence Day holiday, we were already 5 days late. Hmph!

Maybe it’s just me, but I just can’t understand how municipalities can get away with stuff like that… Granted, they don’t start charging interest until you’re a month overdue, but still…

Even worse, looking at the bill — they don’t have a due date printed anywhere. Seriously. Just a threatening paragraph about not being able to register your vehicle in the future if your paid taxes aren’t current. No return envelope either. And you can’t pay online.

Not very convenient.

I can’t remember the last time I actually addressed a blank envelope.

Probably about this time last July.

Anyway, this year the tax due on my two vehicles totals $427.54.

I’m pretty happy about that. Much less than I’d expected and far less than just last year.

I was prepared, actually, for an increase back in April when I’d read that, “Most homeowners will see a property tax hike of at least $150 this year if the proposed budget eyed by the city’s Board of Finance is approved.”

That proposed budget was approved, but upon re-reading the article, it (the budget) didn’t go into effect until this month so the tax hike will actually hit us on next year’s bill.

For fun, I went back and dug up all of my previous personal property tax bills. Okay, not all of them, but as far back as I still had the stubs on file — back to 2001 — and I was surprised by what I found:

Turns out, I had much reason to be pleasantly surprised by this year’s bill. It’s the least I’ve ever had to pay. A full $200+ less than last year! Fantastic!

Don’t get me wrong though… Not for one second am I saying that getting a $400+ bill in the dead of summer is anything to be jumping for joy about.

It’s not.

But July just so happens to be one of those mystical 3 paycheck months for me, so paring an additional $400 from the budget isn’t anything to worry about.

And how on earth was I able to pay a $701 tax bill back in 2002? Yikes!