Taxes Filed – Refund(s) Received!

I’ve been *so* behind with posting over the last few months so much so that I didn’t even do my annual “I Filed my Taxes Today” post this year.

I’ve been *so* behind with posting over the last few months so much so that I didn’t even do my annual “I Filed my Taxes Today” post this year.

Cutting to the chase, I filed my taxes back on February 13. It was a fun filled Saturday morning spent in front of the computer telling TurboTax that, no, once again, I did not earn any income working on a farm and I don’t have an illegal alien working as a maid and living under the basement steps.

Seriously — you spend far too much time answering questions that only apply to a tiny tiny tiny slice of the population but good luck finding where to enter how much you paid in property taxes…

Or how to get your $1000 credit for making a person? I checked the box but I didn’t see my refund magically go up $1000… Whatever…

Anyway, 2009 was a bit of a step backwards in the Smurf household. We earned around $10k less.

That’s okay though — unlike a lot of folks my age, I’m fully aware that my top earning days are behind me. I neve expected my income to continually rise the way it did through my twenties and I’ve definitely run into a plateau of sorts.

Maybe 2010 will be better but I doubt it. Some might blame the economy, or whatever, but the fact is, at a certain point, you just level off. I’m cool with that.

The good news is that we didn’t owe this year like we did last year. I wasn’t sure *how* that was the case last year but we took steps to make sure that it wouldn’t happen again.

Making $10k less didn’t hurt our cause either.

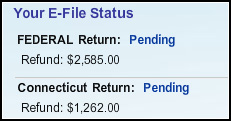

In the end, as you can see up at the top, we received $2585 back Federal and $1262 back from the State for a grand total of $3847.

No small sum but I have to admit — I really thought we’d be getting more.

I’m glad that I wasn’t counting on it but I almost feel naive for actually thinking that having a kid would “aid” me in my taxes in a get-rich-quick sort of way.

Right now, it sorta feels like that “buy a house and you’ll get tons of money back on your taxes” myth. I fell for that one too.

Gee — borrow over a hundred thousand dollars, pay thousands upon thousands of dollars in interest and then we’ll give you $30 back on your taxes for your troubles. Such a deal!

Maybe it’s just me…

Oh, and I’m pretty sure I ranted about this last year but I’m going to rant about it again this year cause it really rubs me the wrong way…

In the mail, I received a Form 1099-G from the State of Connecticut indicating that I “earned” $1258 from them in 2009 and that I had to report it as income on my taxes.

Okay, so I was over taxed in 2008 by $1258. Then, in 2009, they refunded me the $1258. And finally in 2010, I need to pay taxes on that same $1258 that I overpaid in 2008.

So, wait, why again do I have to pay taxes on my refund?

I already over paid taxes on it once — the state gave it back to me — and then I had to pay taxes on it again?

Double taxation, no?