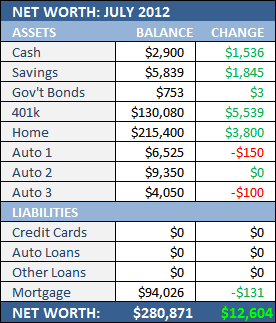

Networth Update: July 2012 (+$12604)

How is it that we’re over half way through the year already?

How is it that we’re over half way through the year already?

Time flies — and I’m thankful that I already reached my financial goal for 2012 with time to spare. Time that’ll undoubtedly fly.

So last month, I got my act back together and the numbers that are in my control (cash, savings, bonds, credit cards, and mortgage) are back where I want them to be.

Cash:

This number is padded as June turned out to be a three paycheck month. The most recent paycheck came so late in the month that I wasn’t able to spend any of it….

Savings:

Yeah, so last month I “borrowed” around $700 to spend on, well, I don’t even rememeber since it’s been so long since I did a spending report (tsk, tsk) but I’ve since “paid” myself back.

Gov’t Bonds:

Someday I’ll have a full grasp on how the interest is calculated on these. I’ve looked it up several times and even “tested” myself to make sure I understand it and, then, just when I’m feeling pretty conifdent about how it all works, I suddenly earn half as much interest. It’s perplexing.

401k:

Pretty nice recovery in June. In fact, June 29th was my best day ever with an increase of over $3k.

On that note, if you happen to keep track of this sort of thing on a daily basis, have you ever noticed that it’s not unsual to lose a HUGE amount on any given day but it’s extremely unusual to gain a ton?

Really, I’ll drop like $2500 in one day. It’ll recover over fiver or six days, a couple hundred dollars each day, then drop all in one swoop again. Really, I have far more up days than I do down days. Far more. Like by a 4-to-1 margin…

But the down days are really, really, really down… It’s just weird.

Home:

This is the highest value I’ve climbed to since May of 2008. Doesn’t seem like that long ago but, holy crap, that’s over four years ago! Time really has been flying…

Auto 1, Auto 2, and Auto 3:

It’s a pretty good month when the only negative report is auto depreciation. And it’s just $250…

Credit Cards:

I’m still spending too much, I think, but this shows that I’m also living within my means.

Auto Loans and Other Loans:

Nothing to report…until I pick up that Lamborghini.

Mortgage:

Just another minimum payment. But I’m about to embark on something new. Well, not new, I’m gonna do exactly what I was doing for years…