Re-focusing the Payment Plan… Again.

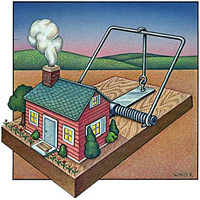

The more I think about it, the more I want to focus on paying down the mortgage.

The more I think about it, the more I want to focus on paying down the mortgage.

When I paid off the last of my credit card debt, the house just happened to become the top priority. Not for any real reason other than the fact that I already had an automatic payment plan in place. With the extra money around, I just increased the size of my payments.

After around a month, though, I realized that it wasn’t exactly the wisest path to take. I switched things up and started paying down my auto loan instead. I also increased my savings rate.

But now, I’m starting to lean back towards the mortgage again…

Yes, all of this flip-flopping in just 2 months time. I should run for office.

I haven’t put anything into place just yet, but while going through my records, I noticed that my mortgage holder (CountryWide) does their escrow analysis on my account each year somewhere between October and November. For the past 4 years, anyway, it’s been one of those two months.

Now, my whole point of paying down the mortgage quickly is to eliminate the monthly PMI that I’m paying out of that escrow account.

Private Mortgage Insurance (PMI) – PMI is extra insurance that lenders require from most homebuyers who obtain loans that are more than 80 percent of their new home’s value. In other words, buyers with less than a 20 percent down payment are normally required to pay PMI.

PMI plays an important role in the mortgage industry by protecting a lender against loss if a borrower defaults on a loan and by enabling borrowers with less cash to have greater access to homeownership. With this type of insurance, it is possible for you to buy a home with as little as a 3 percent to 5 percent down payment. This means that you can buy a home sooner without waiting years to accumulate a large down payment.

Under HPA, you have the right to request cancellation of PMI when you pay down your mortgage to the point that it equals 80 percent of the original purchase price or appraised value of your home at the time the loan was obtained, whichever is less. You also need a good payment history, meaning that you have not been 30 days late with your mortgage payment within a year of your request, or 60 days late within two years. Your lender may require evidence that the value of the property has not declined below its original value and that the property does not have a second mortgage, such as a home equity loan.

Eliminating the PMI from my mortgage bill would essentially ensure that an additional $85.15 would go towards principle each month. (Technically, my minimum mortgage payment would go down after the analysis, but I’d continue to send in the same amount on my own — resulting in the $85.15 per month increase.)

That sounds like a good thing, right?

Well, considering that my regular payment applies less than $300 towards principle each month, an additional $85.15 is like increasing my payment by over 25% — and that’s without sending them an additional dime. That makes it very attractive.

As of today, I have $1901 more to knock off the principle before I can safely request that they remove the PMI from the calculation.

To be safe, I think I should press to reach that goal by September, at the latest, to ensure that I get there before they kick off their analysis procedure.

(I’m aware that I can request that PMI be removed any time after I reach the 20% level, but the escrow analysis locks in my monthly payment for an entire year. If I don’t make it by the upcoming analysis, what was going towards the PMI will just sit in the escrow account and result in an escrow overage. In that case, they’ll send me a check of the difference in November of 2009 after the next analysis — not exactly ideal which is why I’m trying to avoid the scenario all together.)

So, with most of my income for June likely being sucked up by our upcoming vacation, I’m thinking that, to be safe, I’ll have to send around $2000 extra towards the principle spread accross July, August, and the first few weeks of September.

That’s a definite possibility if I scale back the current plan of $1000 towards the car and $1000 towards savings each month.

Actually, if I were feeling really daring, I’d just take the $2000 I have in savings right now and send it right to Countrywide and call it a day (or year?)… Nah, not feeling it…