Wipe Out Debt Faster

Years ago while paying down my mortgage in a fruitless attempt to eliminate PMI, I posted a graph showing how much of an effect additional payments have when it comes to paying down debt.

Back then, it was just an extra $25 per week and, boy, did it ever make a difference!

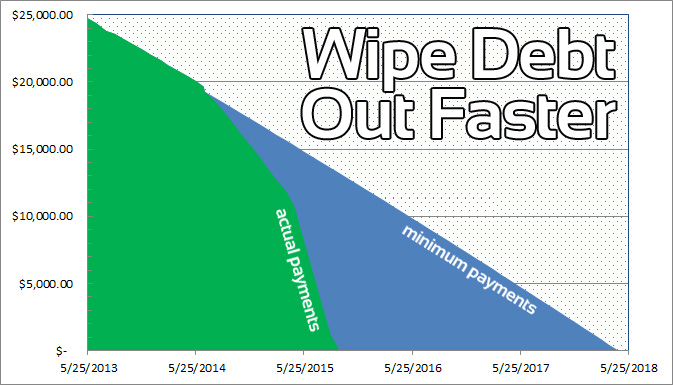

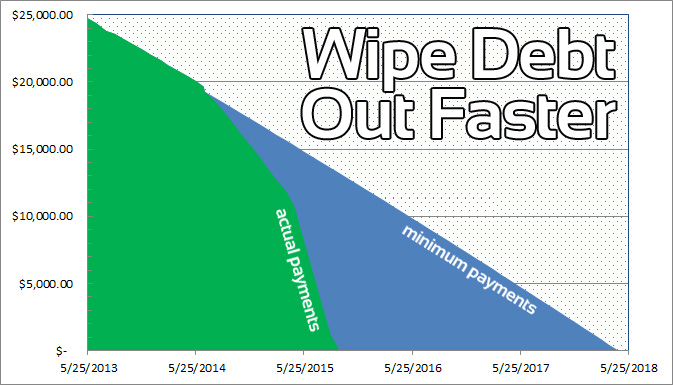

Of late, my target has been my $24750 auto loan taken out in April of 2013 and will you look at that slope change since I started up’ing my payment schedule! Wow!

Visuals are great motivators, I find.

So the blue part is the amortization schedule, you know, how it’d all go if I made the minimum monthly payment for the duration of the loan.

The green part is what my actual balance is currently — and will be as I extrapolated the data out a few months until the balance is paid in full.

As you can see, for the first year or so, I was just making the minimum monthly payment of $444.15, you know, just getting acclimated to having a car payment after so many years of owning my cars free and clear.

At around the 1-year mark, I started tossing an additional $102.50 each WEEK towards the loan in a effort to speed things up.

Granted, that’s a lot of money to have lying around on a weekly basis but you’d be amazed at what you can make do without — especially when you have it set-up to be taken out automatically.

Honestly, I’m at my best when I’m cash poor. I’ve said it over and over — I’m amazing at paying down debt but horrendous at saving money.

The key for me is to not have any money to spend. Can’t spend what I don’t have. And the reason I don’t have any is because I’m sending most of it towards my debts — on auto-pilot.

Now, within the past month or so, I’ve stepped it up a notch with crazy with $452 payments (WEEKLY!) that essentially line the entire balance to be paid in full this August.

Yep, before the mid-point of the original amortization schedule — even with just paying the minimum payment for the first year!

— — — — —

For the record, I never was able to get Countrywide Home Loans to stop billing me for PMI (Private Mortgage Insurance) even though I was far beyond the threshhold that it should have been dropped (automatically, I might add) even after numerous phone calls and letters.

To solve the problem and rid myself of an expense I no longer should have had to pay, I ended up re-financing with another bank and cut my mortgage bill by nearly 60%.

Their loss.