Recently, I had to purchase a car on short notice and a quick trip to CarMax solved my situation — same day.

Recently, I had to purchase a car on short notice and a quick trip to CarMax solved my situation — same day.

Great experience all around.

When it came down to do the financing, the first question I was asked was “How much are you going to put down?”

They didn’t seem taken aback when I said, “Nothing” but, well, I could tell I was being judged.

I’m sure they hear something along those lines all the time…so I followed it up with, “Always better to use someone else’s money…”

Evidently skeptical of my ability to pay, they proceeded to tell me that the larger the down payment, the better the finance offer would be and how it would lower my monthly payments and, well, you know all that stuff that they use to pressure you to get a larger sum of money up front.

Yeah, not gonna work with me. Besides, I didn’t have a dime (or checkbook) on me.

When they submitted my loan inquiry (via computer), I got the vibe that they thought, yeah, we’re not getting a sale today.

No one is going to finance this deadbeat that came walking in here looking to buy a car in under 30 minutes with nothing down…

As the hourglass on the computer continued to spin from top to bottom for over 5 minutes, they asked me, “Are you sure your mortgage is only $498 per month?”

It was one of the few questions they’d asked, besides my social security number, that they’d use to check in on my ability to pay.

“Wow, it’s never taken this long…”, they exclaimed and even followed with “you should put everything out up front, they’ll find it if you don’t” as if that was the reason it was taking so long for a response to be returned.

Yeah, they were totally convinced I’d wasted their time, I could tell, even asking if I’d reconsider making a down payment under the guise, “It makes the loan more attractive to the lenders we use…”

At this point, while I too was begining to sweat it, I was still confindent in my ability to qualify for a loan. Extremely.

Following an epic 10 minute wait, where I had started to think the computer had just frozen — boom!

A loan offer was displayed.

I could tell by the salesman — and his trainee watching the entire process — that they thought something was wrong.

Not only was it from CarMax’s in-house Auto Finance department (and not some bank I’d never heard of) but it didn’t make sense to them.

The top line on the screen displayed a loan of $19000 at a rate of 0.99% for 36 months.

I’m no loan shark and I’ve never been involved in the auto sales industry, but I’m pretty certain that’s a pretty sweet offer for a used car loan.

As they were preparing to click and accept the loan, I stopped them and asked if I could push it out to 48 months. Or even the max, what was the max?

They cautioned me that extending the term may lower my monthly payments but the rate on the loan offered would jump — it would be a poor decision to turn down the *AMAZING* rate offered sitting on the screen.

I went in to my “offering financial counter-advice” mode and explained that cash flow *is* everything.

My primary goal today was to buy this car with ZERO money of my own and to secure the lowest the monthly payment possible…

Since this a simple interest loan being offered — I’d already confirmed that as well as the lack of a pre-payment penalty — the term of the loan holds no weight, nor will the higher interest rate (relatively speaking — as long as it doesn’t jump 10% or something).

With a longer term, I’ll have the added flexibilty of a lower monthly payment (which means MORE cash in my pocket each month) and still have the option to pay it off, as I plan to, in 36 months, 48 months, or whatever without any penalty.

Reluctantly, they turned down the offer sitting there on the screen, thinking I’d been offered a rate I didn’t qualify for anyway, and set it to seek a loan with a 72-month (the max) term.

Less than 30 seconds later, another offer displayed on the screen from the same in-house lender.

72 months at 3.9% and a minimum monthly payment of $300.76.

Offer accepted.

Twenty minutes later, I drove out of there in a new (to me) car without spending a dime.

Twenty minutes later, I drove out of there in a new (to me) car without spending a dime.

So, here’s the deal…

Going in, I knew that my Experian Score was 846 out of 850.

I can not stress enough how having good, err, great credit is.

It’s so rare these days, it seems, but I’ll tell you, it opens such better financial opportunities and, frankly, a boosted self confidence walking in too.

I’ll admit, I was a little worried as it took so long for an offer to come through but I knew, without a doubt, that I’d qualify for a loan.

A good loan.

Had I accepted the initial offer, 36 months at 0.99%, my monthly payment would have been over $525 per month. I don’t recall the exact amount but I sure as hell wasn’t going to pay over $500 per month for a used Ford, that’s for certain.

The offer that I did accept with the longer term and higher rate landed me a monthly payment of just over $300 per month.

Still a sizeable sum, yes, but a sum that allows me an additional $200 per month to do with what I please.

Wanna know the crazy part?

If I happen to send them that extra $200 each month, in addition to my $300 minimum payment, I’ll have the car paid off in 40 months — just four months longer than the original offer.

To me, having the ability to “cut” $200 off of my bill anytime I please is well worth an additional four months of payments on a loan…three years from now.

So, the moral of the story?

Great credit may earn you super low rates…but don’t get fishhooked by the rate!

Yes, your credit history earned you that rate…but you can do better!

Push the term out, use the savings to add to whatever it is you’ve been doing that earned you that credit score, and you’ll end up paying off the loan years early *and* have more money in your day-to-day finances to make additional wise manouevres.

This is the best piece of advice I wish I’d learned before figuring it out on my own.

Yes, yes, I know people “payment” shop when looking to buy or, worse, lease a car but it’s what you do with the savings you gain from the lower payment that makes the difference.

Ideally, you want all of your required monthly payments to be as small as possible so as to maximize your available cash at all times.

I wrote a post back in 2015 that nails it on the head when it comes to paying your debts back effectively and efficiently.

Never allow yourself to become a slave to your debts — you can set the timetable and payment schedule.

If you’re disciplined enough, you really can have your cake and eat it too!

Look at me — I have a new car, a low payment, and cash in my pocket.

Can’t get much better than that, can it?

History repeating?

Always on the hunt for an easy way to make passive income, I dipped my foot into the realm of peer-to-peer lending back in February of 2016.

Always on the hunt for an easy way to make passive income, I dipped my foot into the realm of peer-to-peer lending back in February of 2016.

Well, being that it’s been two years since

Well, being that it’s been two years since

Recently, I had to purchase a car on short notice and a quick trip to CarMax solved my situation — same day.

Recently, I had to purchase a car on short notice and a quick trip to CarMax solved my situation — same day. Twenty minutes later, I drove out of there in a new (to me) car without spending a dime.

Twenty minutes later, I drove out of there in a new (to me) car without spending a dime. Only a few weeks late with this…

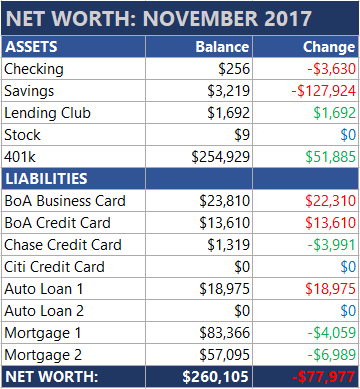

Only a few weeks late with this… Yeah, so last month I was pretty confident that I’d turned a corner and was well on my way to building wealth again…and then I ended up down another 8 grand…

Yeah, so last month I was pretty confident that I’d turned a corner and was well on my way to building wealth again…and then I ended up down another 8 grand… What a month!

What a month!

Youth sports are funny. On the sidelines, as parents, in our cheap folding chairs, we’re all pretty much equal.

Youth sports are funny. On the sidelines, as parents, in our cheap folding chairs, we’re all pretty much equal.  So I scoped out a couple of them on local real estate sites to get a glimpse of what the interiors look like and, yep, as expected, they’re all really nice. Duh.

So I scoped out a couple of them on local real estate sites to get a glimpse of what the interiors look like and, yep, as expected, they’re all really nice. Duh.