So the markets are just roaring so far in 2013. It’d be hard to imagine anyone is “down” this calendar year — unless you’re really, really terrible at investing.

So the markets are just roaring so far in 2013. It’d be hard to imagine anyone is “down” this calendar year — unless you’re really, really terrible at investing.

Since I started purchasing individual stocks last December, a couple of my choices are up over 40%.

I should probably cash out.

In fact, I know I should.

I’ve made my money — take it while you can.

Well, that’s where the problem lies…

As I’ve mentioned in the past, I’m a hoarder.

I like to accumulate.

(No — I’m not like the hoarders on television…)

It’s been working great for me with my 401k — and my hockey jersey collection — where I just keep adding to the pile and the value consistantly keeps getting bigger and bigger.

That’s not how it works with individual stocks.

As a mostly absent portfolio manager, I have no desire to be a day-trader or anything but I totally understand the concept of buy-low-and-sell-high.

I know how that works and how it leads to wealth at a much advanced pace.

I just never pull the trigger. I grow too attached or something.

Looking back on my childhood, we moved every few years to a new house. Each subsequent move was to a bigger and better house.

I wasn’t privy to the mortgage bill or anything, since I was only 7 years old by the time we hit the fourth house, but I do see how you can go from house-to-house, getting bigger and better along the way, while keeping your mortgage bill roughly the same.

The size of the house doesn’t determine the size of the mortgage — the folks accross the street from us paid DOUBLE what we did for a similar but smaller house.

I’d bet if you compared our two mortgages, you’d be hard pressed to determine that we live in the same neighborhood.

Buy low, sell high. That’s the path to take…up, and up, and up…

I know that.

Yet I sit in my first and only house today — knowing full well that I can technically afford something twice the size and, by now, could probably be in something three times the size.

The reasoning there is a bit more complicated, though, since I like where I live and enjoy the freedom that a sub-$500 mortgage allows us.

But there shouldn’t be any irrational emotional connection with the stocks!?

Dude, you’ve made over $80 on a $200 investment in less than a month. Sell Tesla now!

I can’t even justify my own reasoning.

It’s like…by holding on longer, I own more or something.

But that’s not how it works. I know that.

If I own two shares at $80 and now they’re worth $100 — I still only own two shares.

I bought low — I need to sell high.

That goes for you, Google, Dunkin Donuts, Tim Hortons, Tesla, Solar City, and Ford.

My only loser was Apple (which I purged in disgust months ago…)

Facebook and LuluLemon have essentially stayed right near what I purchased them for.

I’m pretty good at picking stocks (even when it’s not a boom year like 2013 has been), I think…

My end game is terrible though.

Funny how I went there earlier this week…

Funny how I went there earlier this week…

So the markets are just roaring so far in 2013. It’d be hard to imagine anyone is “down” this calendar year — unless you’re really, really terrible at investing.

So the markets are just roaring so far in 2013. It’d be hard to imagine anyone is “down” this calendar year — unless you’re really, really terrible at investing. While I’m not a British Subject — a term that’s incorrectly used all the time — I am still a Commonwealth Citizen so I do have a little skin in the game…

While I’m not a British Subject — a term that’s incorrectly used all the time — I am still a Commonwealth Citizen so I do have a little skin in the game…

Of late, as in just over the past couple weeks, the local television newscasts have neen using the “block” term when reporting stories — usually of the crime or housefire variety.

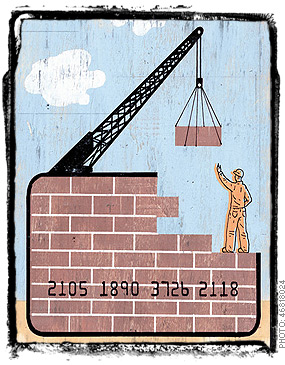

Of late, as in just over the past couple weeks, the local television newscasts have neen using the “block” term when reporting stories — usually of the crime or housefire variety. Step 1. Halt savings and eliminate credit card debt.

Step 1. Halt savings and eliminate credit card debt. Okay, so there’s some tumbleweed tumbling around here lately.

Okay, so there’s some tumbleweed tumbling around here lately.