Okay, I’m ditching the goal of finally getting a Roth IRA account set-up and fully funded in 2010.

Okay, I’m ditching the goal of finally getting a Roth IRA account set-up and fully funded in 2010.

It isn’t that I can’t afford to do it… It’s just that a good old fashioned incandescent light bulb finally lit up (powered by knob & tube wiring) and I re-remembered why I’d never opened an account in the first place.

The big hurdle that I don’t want to have to confront is all that business about access to the money.

Specifically, it’s the lack of access to the money — even with a Roth — that turns me off.

My 401k already has over $85k tied up that I can’t touch for the next 26 years. That’s a really long time. And it sure feels like an awful lot of money too…

A Roth IRA on top of it all would just make more of my money inaccessable — when I kinda need it.

Now I’m not going to stop contributing to my currently match-less 401k or anything. I’ve toyed with the idea but haven’t acted on it and I’m not planning to.

But I’m also not keen on the idea of locking more of my income away where I can’t get at it.

A decent selection of plain Jane mutual funds would probably suit me better. Same risk with full access.

(The tax implications, or ‘advantages’, are, as far as I’m concerned, minimal.)

And that’s the key — if I need the money before my knees are completely shot (which I will), I can get it.

For now, though, the money that would have gone to fund the Roth IRA will be probably be split very unevenly between savings and mortgage overpayments.

Sorry — you just can’t convince me that having your house paid for in your mid-thirties is a poor financial strategy…

To me, eliminating the biggest monthly bill forever is financial freedom.

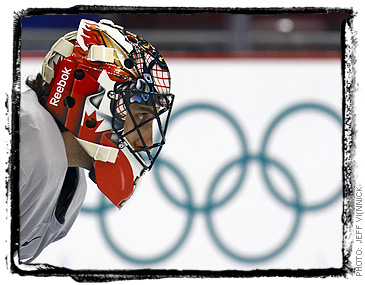

Oh, yeah, and GO CANADA!

I’m no expert, but a few months ago when

I’m no expert, but a few months ago when  Hmmmmm… Which to choose…

Hmmmmm… Which to choose…  I’ve already stated that I’m

I’ve already stated that I’m