Yep, I moved in on September 30, 2002.

Yep, I moved in on September 30, 2002.

I remember it being a crazy busy day at work — I actually didn’t even take a long lunch for the closing.

Drove to the lawyer’s office, signed my stuff, got the keys, did a drive-by of the house on the way back to work (the previous owners were still hauling stuff out to the curb), and then returned to work before my lunch hour was up…

If I were to do it all over again… I’d have taken that day off.

Actually, the entire week. I’m pretty certain that it was a Monday.

In these 6 years, I’ve sunk a lot of money into this house. A really rough estimate would be around $60k. The only thing I can think of that is attached to the house and that hasn’t failed me yet is the water heater…

Yeah, one of the least expensive pieces in a house…

But I wouldn’t classify it all as throwing good money in after bad. Okay, sometimes I think of it like that, but in reality, it’s not like that at all.

Dollar-wise, most of it has been in the past two years in the form of the new roof and siding — combined, their price tag topped $40k. Both have been documented here on PIAC.

Mortgage-wise, though, the movement of money has been like molasses in February…

I financed $131,000. My balance today is $109,089.

The difference is $21,911.

That’s like, well, that’s like a cheap 4-door sedan that’s taken me SIX YEARS TO PAY FOR!!!

When I look at it like that, aside from all of the PMI drama, it really makes me want to throw down and just pay the mortgage like it’s, well, like it’s NOT an auto loan.

I realize that at these early stages of a 30-year loan that there’s a lot of interest working against me. My total payments have probably already exceeded 6-figures…yeah, that’s A LOT of interest…

But even now, 72 months in, looking at it closer, for every $1200 payment, only $230 of it actually hits the principal while $600 goes towards interest. The remaining $370 goes into the escrow account and, well, let’s not get into that… Grumble, grumble…

I’m pretty proud of the fact that this year, 2008, I’m on pace to knock $11k off of the balance on my mortgage.

To think, at this time last year, I’d only knocked off maybe $9k total over 5 entire years…

That averages out to $150 per month.

You can’t even get a Kia Rio with that kind of payment?! What was I doing? (Rhetorical question… I know what I was doing — I was amassing a ton of credit card debt and then paying down that same ton of credit card debt.)

So now, I find myself accustomed to over-paying the mortgage.

That’s a good thing.

Right now, I’m knocking between five and six hundred dollars from the principle each month and it’s comfortable. Just my regular payment and a weekly $75 auto-payment.

For a few months there, I was out of control — knocking thousands off in less than a month. Over the top. I went so far as to use a credit card to finance an extra payment… How crazy is that?

I’m not going to go all out again anytime soon — I had a goal, I met it, but I didn’t get the results I was expecting. I’m over that.

But in doing that, I proved to myself that I am capable of sending that kind of money towards the mortgage.

I’m not saying that I’ll pay down $11k between now and September 30, 2009 but I might. I mean, as the interest drops as the loan matures, it will get easier and easier, right?

Yeah, it will. Add to the fact that I’m on the cusp of becoming truly debt free, well, my month to month budget is in for some changes.

Sure, I say I’ll boost my savings, and I’m sure I will, but I’m also pretty certain that I’ll increasingly overpay my one monthly debt payment in a quest to eliminate it too…

I just need to increase it slowly…

Maybe I’m the only one who reads the fine print or listens to the hushed fast talking at the end of radio and television commercials, but I’m pretty certain that every single financial advertisement says something like, “Remember that investments are subject to risk, including possible loss of principal,” or “Before investing, consider the investment objectives, risks, charges, and expenses.”

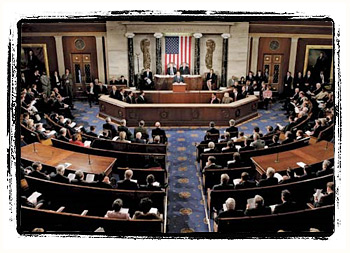

Maybe I’m the only one who reads the fine print or listens to the hushed fast talking at the end of radio and television commercials, but I’m pretty certain that every single financial advertisement says something like, “Remember that investments are subject to risk, including possible loss of principal,” or “Before investing, consider the investment objectives, risks, charges, and expenses.” Perhaps this is insensitive of me, but regarding the apparent urgency of a bail-out plan (which I personally don’t support anyway), why again is Congress taking a few days off for some Jewish holidays?

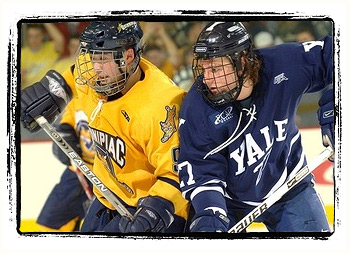

Perhaps this is insensitive of me, but regarding the apparent urgency of a bail-out plan (which I personally don’t support anyway), why again is Congress taking a few days off for some Jewish holidays? I’m pretty sure that I’ve mentioned that my wife and I often go to professional sporting events.

I’m pretty sure that I’ve mentioned that my wife and I often go to professional sporting events.

I did it.

I did it. So I was looking at my Google Analytics reports early this morning and noticed a new network location listed under the “Visitors” tab.

So I was looking at my Google Analytics reports early this morning and noticed a new network location listed under the “Visitors” tab. Just read this in the paper this morning — front page news, actually, in the local daily.

Just read this in the paper this morning — front page news, actually, in the local daily.