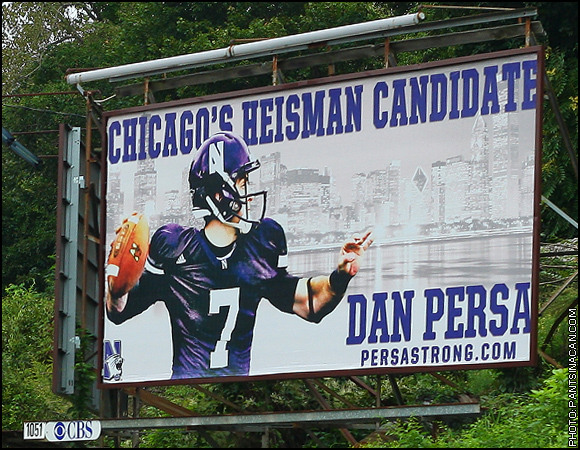

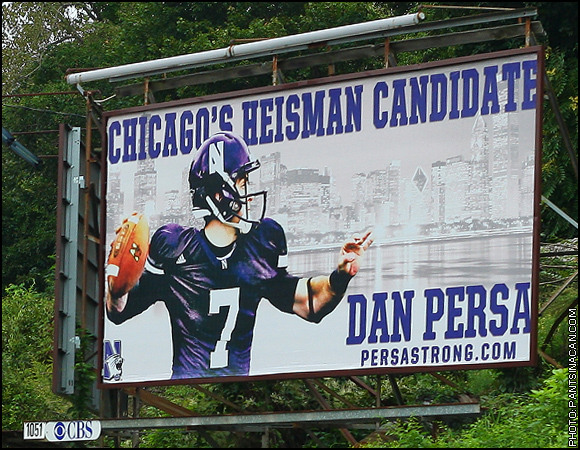

About a month ago on my way to work I noticed a billboard that seemed, well, out of place.

In the past, it’s been Pepsi, McDonalds, or some obnoxious local attorney advertisement.

But this…”Chicago’s Heisman Candidate” seemed a little out of place in central Connecticut.

We’re a good 900 miles from Chicago…

And I’ve never heard of Dan Persa. If he were a local kid in the running for the Heisman trophy, you’d think there’d be some media coverage.

And I’ve never heard of Dan Persa. If he were a local kid in the running for the Heisman trophy, you’d think there’d be some media coverage.

I mean, Connecticut isn’t exactly a football hotbed so a local kid in the running would be BIG news.

Then I began to think that maybe Northwestern University transposed a number when ordering the sign from CBS Outdoors.

Sign 1501 is probably located in Carol Stream, Illinois. Sign 1051 happens to be in Bristol, Connecticut.

Oops.

And then I referred to the trusty internet to find some answers.

Dan Persa is not from Connecticut.

He’s a 22-year old quarterback from Bethlehem, Pennsylvania that plays for the Northwestern Wildcats.

And the billboard?

It’s exactly where they wanted it… Seriously.

From the Chicago Tribune:

Northwestern is going into the heart of college football country — Bristol, Conn. — to promote Dan Persa’s Heisman Trophy campaign.

Make that the heart of college football opinion country. Bristol is home to ESPN, and NU officials have bought billboard space there on a key artery. Chicago commuters can see the ad next week on a Kennedy Expressway billboard at Kimball Avenue.

NU officials chose the theme “Persa Strong” after ESPN.com’s Bruce Feldman named Persa the 10th-strongest player — and strongest quarterback — in the nation. The 6-foot-1, 210-pound Persa can bench-press 360 pounds and squat 520.

Persa has not seen the billboards but said, “Anything that can get more attention for our team around the country is cool.”

Well, I hate to tell them but…the sign isn’t on a route that many ESPN commuters will ever see.

It’s actually angled in a way where you can only see it while driving away from ESPN.

Making matters worse — it’s on a road through an industrial zone. A, how shall I put this… depressing and out-dated industrial zone. Yeah, it follows a seldom used freight rail line… you know the type of road…

Not a deadend by any means but certainly not a main artery for the influential on-air ESPN employees that they’re trying to sway.

Point being — I highly doubt Chris Fowler, Kirk Herbstreit, or Bruce Feldman have seen this sign or ever will even though they’re often just a couple of miles away.

The security guard for the lot they park in, well, he’s probably seen it.

But I suppose it got some publicity here on PIAC so it’s not all for nothing.

I don’t think that’s exactly what they were aiming for though.

Anyway, good luck Dan Persa!

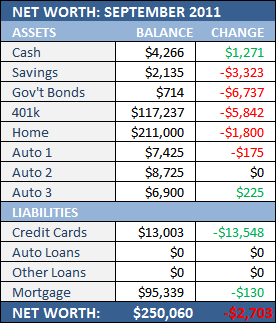

How come people use the phrase “quarter of a million dollars” but you pretty much never hear anyone say, “quarter of a hundred thousand?”

How come people use the phrase “quarter of a million dollars” but you pretty much never hear anyone say, “quarter of a hundred thousand?”

I’ve written a lot about homeowners insurance in the past.

I’ve written a lot about homeowners insurance in the past. How could I not review this movie?

How could I not review this movie?

And I’ve never heard of Dan Persa. If he were a local kid in the running for the Heisman trophy, you’d think there’d be some media coverage.

And I’ve never heard of Dan Persa. If he were a local kid in the running for the Heisman trophy, you’d think there’d be some media coverage.

Summer is over and along with it is the season of spending.

Summer is over and along with it is the season of spending. In a complete reversal of

In a complete reversal of