I’ve seen a couple of articles over the past couple of weeks on this topic. Essentially they’re just fluff pieces filling space in the business pages but everyone likes fluff pieces…

Anyway, I live in Connecticut so I’m going to focus my attention there.

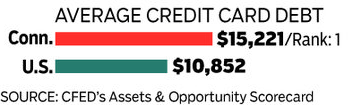

Huffington Post – January 22, 2012

Credit Card Debt: $7,730 (3rd highest)

Median Household Income:$64,032 (4th highest)

Average Credit Score: 672 (9th highest)

Cost of Living: 4th highest

Connecticut is often recognized as one of the country’s wealthiest states. This is a well-earned reputation. The state has the fourth-highest median household income. The cost of living is also higher than that in all but three states. Residents, therefore, spend more than those in most other states. Average credit card debt is the third highest in the country, but not surprising, their credit scores are also high.

– – – – – – – – – – – – – – – – – – – – – – – – –

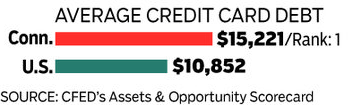

Hartford Courant — February 2, 2012

Classic example of how you can make numbers say whatever you want them to.

Niether article really listed how they came to these values but I think it’s funny that the largest newspaper in Connecticut came to the conclusion that we’re number one while the Huffington Post (with a more national audience) only put us in third.

All of that aside, where do I stack up?

My current credit card debt totals $6635. Lower than either stat above.

Less than a year ago, it was $28165 which far exceeds them both.

So since I’ve been on both sides, above and below, I think I’m equipped to have a knowledgeable opinion.

Well, not surprisingly, I do.

The Huffington Post puts Connecticut in third place in the nation with an average debt balance of “just” $7730.

No freakin’ way.

First off, I don’t think $7730 is nearly high enough to be third in the country. No way.

How many women between the ages of 18 and 45 do you see walking around with $400 Coach purses with matching $250 rubber boots? They’re all over the place around here.

I don’t have a problem with it (the boots are pretty fugly, though) but I don’t have the income to justify spending that kind of coin on some ugly accessories.

As our household income is considerably higher than the stat listed, I’d pretty comfortable saying that 80% of those Coach accessories were purchased with a Visa, Mastercard, or, heaven forbid, a Discover Card.

And that’s just the tip of the iceberg, I mean, we’re just talkin’ purses and boots here… and, for the guys, I’m pretty sure it’s not cheap to pimp out a Subaru either…

So I’d say the average 24-30 year old in Connecticut is carrying a 5-figure credit card balance. Easily.

And a $20k auto loan too… with an income well shy of $64k per year.

So… I’d say the Hartford Courant’s $15k number is more accurate — but probably not high enough to rank number one.

I mean, Connecticut isn’t New York or California… We’re third.

But combine the two articles and I think you’ve got the accurate result!

Step 1. Halt savings and eliminate credit card debt.

Step 1. Halt savings and eliminate credit card debt.

So it’s been 3 years since

So it’s been 3 years since

How come people use the phrase “quarter of a million dollars” but you pretty much never hear anyone say, “quarter of a hundred thousand?”

How come people use the phrase “quarter of a million dollars” but you pretty much never hear anyone say, “quarter of a hundred thousand?” For me, it’s to go with my first instinct and to do it quickly.

For me, it’s to go with my first instinct and to do it quickly. It only took an entire year but, finally, this afternoon,

It only took an entire year but, finally, this afternoon,