Well, being that it’s been two years since I last posted an update, I know I’m not taken aback by the HUGE sways in the chart over there.

Well, being that it’s been two years since I last posted an update, I know I’m not taken aback by the HUGE sways in the chart over there.

I mean, a lot has happened over the past two years…and my finances certainly show that.

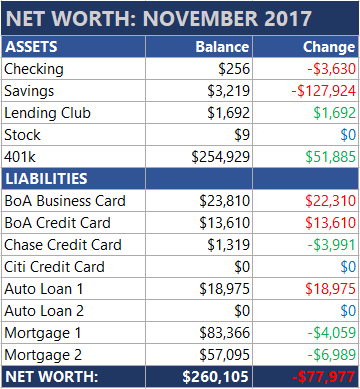

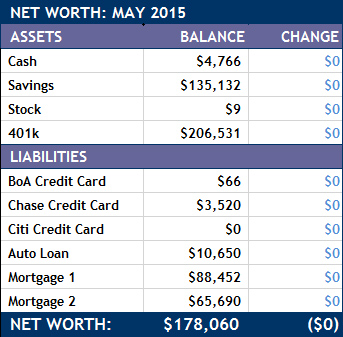

Let’s start at the top… My checking account balance is dreadfully low. I’m still on one of those plans where if my balance drops below $1500, I get charged a $14 maintenance fee.

With so many “free checking” options out there, I should probably inquire about switching the type of account I’m on as it’s been a monthly trend for me to drop below that threshhold — though I must admit, I’m not ususally *this* low.

That said, my spending has changed drastically since November of 2015. DRASTICALLY. I’ll share that news soon.

Regarding savings, yep, you’re seeing that correctly. My stash in savings dropped 6-figures…but it was money well spent. Remember that garage I fantasized about for years? Well, we built it. And it cost a lot.

The “Lending Club” line is new. Much like my experiments with stocks and i-bonds in the past, I dipped my toe into the peer-to-peer lending pool to see if it there was any easy money to be made.

The answer to that question is…no. But I will say, after 18 months or so in the game, I’ve figured out what not to do…so my tiny earnings will no longer disappear due to loans offered to deadbeats.

As for stocks, yes, somehow the $9 I had in my ShareBuilder account two years ago is still worth just $9. Actually, it’s $8.92. I rounded up.

And my 401k is on the up-and-up. I’m sure President Trump is who I should give the most credit to, huh? Yeah, that’s not going to happen. Ever.

Oh, the credit cards. For someone that’s dug themselves out of $30k in credit card debt, fully documented on this site, not once…but twice, I’m sure it’s hard to fathom that I currently find myself nearly $40k in credit card debt alone today.

Well, that garage we built was expensive…and we didn’t finance any of it (besides the second mortgage we took ouy years in advance) so I was using the plastic exclusively for a long time.

The good news is that the garage is 98% complete and 98% paid for. The fact that I’m only $40-thousand in the hole as a result makes me feel pretty okay. I’m in pay down mode now. You’ll see. Stick around for the ride.

You’ll notice a couple of lines for auto loans. Well, those are new too.

See, my trusty Scion xA (that I paid off in 2008) left me stranded a few hundred miles from home a few weeks back and I had to buy a new (to me) car in a hurry.

Then, this past week, the Swagger Wagon my wife drives (that we paid off in 2015) was hit by an uninsured driver. Wonderful.

Still waiting to see if it’s going to be repaired…our insurance company is taking their sweet ass time but I think the writing is on the wall — we’re going to “add” two auto loans within the span of one month.

And the mortgage balances are what they are.

Truthfully, I thought a two year gap would show more progress but the fact that I’m sending minimum payments in — wisely, I might add — is likely to blame.

Once that credit card debt is gone, Mortgage 2 will be the primary target. It’s currently my largest monthly bill coming in at $573.48…and I hate it.

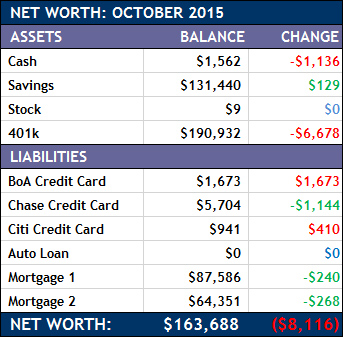

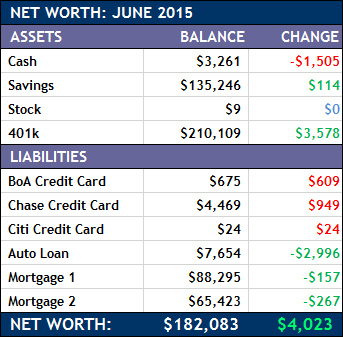

Only a few weeks late with this…

Only a few weeks late with this… Yeah, so last month I was pretty confident that I’d turned a corner and was well on my way to building wealth again…and then I ended up down another 8 grand…

Yeah, so last month I was pretty confident that I’d turned a corner and was well on my way to building wealth again…and then I ended up down another 8 grand… What a month!

What a month!  I often say that “Data Don’t Lie” but sometimes it’ll really surprise you.

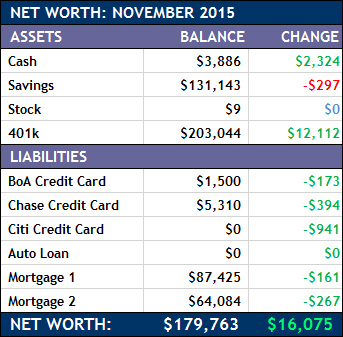

I often say that “Data Don’t Lie” but sometimes it’ll really surprise you. Another month, another net worth update.

Another month, another net worth update.

So the good news is that I’m still on the up-and-up when it comes to the bottom line.

So the good news is that I’m still on the up-and-up when it comes to the bottom line. Would’ve been neat to see my progress during the past couple of years when I was essentially “ignoring” my finances.

Would’ve been neat to see my progress during the past couple of years when I was essentially “ignoring” my finances.