The whole bonds to stocks move I made back in December has been pretty darn successful in the grand scheme of things. Had I not purchased a cent worth of Apple, well, things’d be even better.

The whole bonds to stocks move I made back in December has been pretty darn successful in the grand scheme of things. Had I not purchased a cent worth of Apple, well, things’d be even better.

Honestly, I’m not even sure *why* we hooked up… Upset with myself.

So, rather than wait anxiously for Apple to recover (when deep down, I hope they never do), I’m going to sell now and buy up some stock in other companies that I have legitimate confidence in.

The first company that came to mind about a month ago was Tesla.

No, it’s not that I think electric-powered luxury roadsters are cool — though I do think electric cars are a better investment than any hybrid.

To me, a hybrid is kinda like half-assing it.

You either do it or you don’t.

You can’t have it two ways!?

Like how Subarus, in particular, which aren’t even hybrids anyway have that “PZEV” insignia badge on the back with the little green leaf.

“Partial Zero Emissions Vehicle”.

Partial Zero?

Say what?

Anyway, since I’m not in the market for an electric car — having just purchased a swagger wagon — why would I invest in Tesla?

Well, I’ll tell you…

First, the company is not named after 80’s and early 90’s rock bank Tesla. You know, that one hit wonder with the song “Signs” where all the girls would sing along with the “Huh” during the break?

Did you know that was a cover tune? It was originally recorded by a Canadian band named “Five Man Electric Band” over 40 years ago now… Look it up.

So, the company is actually named after Nikola Tesla — a bad ass inventor from back in the Thomas Edison days that probably should have electrocuted himself multiple times. In fact, I’m sure he did.

So, the company is actually named after Nikola Tesla — a bad ass inventor from back in the Thomas Edison days that probably should have electrocuted himself multiple times. In fact, I’m sure he did.

Anyway, geeks know who Nikola Tesla is. I used to be a geek.

And the CEO of Tesla Motors is a geek — a geek that I went to school with.

Elon Musk went to the same university that I did and though we only crossed paths once or twice (he’s a couple years older), I didn’t forget him.

The unusual name was partially to blame.

Okay, mostly to blame. Ever notice how many people you encounter with really really unusual names in University? Where do they all come from?

Anyway, after leaving school, he went on to create PayPal of which I was an early adopter prior to it even being called PayPal since I’d heard around campus that it had been developed by “one of ours”…

So, he hit the ground running right out of school, started a bunch of really successful companies — including Tesla Motors, and hasn’t really looked back since.

He’s a winner — and having done it repeatedly, dumb luck can’t be to blame.

Sign, Sign, Everywhere a Sign

So, to recap: Nikola Telsa played with electricity, the band Tesla covered a song by Five Man Electrical Band from Canada, Elon Musk grew up in Canada and founded a company that he named Tesla to make electric cars.

To quote a line from the song, “Can’t you read the signs?”

I should have bought this stock a long time ago.

Of course they’ve been on a tear this past week or so having now started making more “regular looking” electric cars — that just got great reviews — and are probably over-valued in the short term but once the price settles into a groove, I’m going with them.

So it’s been 3 years since

So it’s been 3 years since

So, as expected, last night

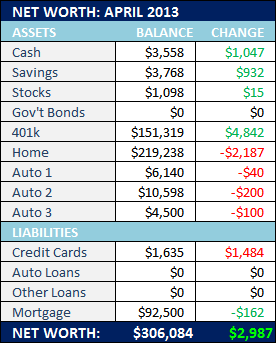

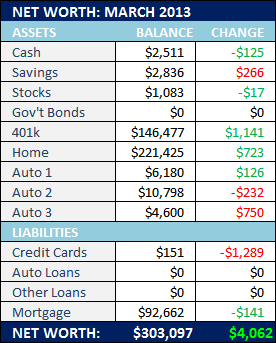

So, as expected, last night  So, while the bottom line isn’t all that great, I’m pretty happy to report that the assets that I have active control of are all going up.

So, while the bottom line isn’t all that great, I’m pretty happy to report that the assets that I have active control of are all going up. It’s about time I catch up on these postings as I’m a few months behind…

It’s about time I catch up on these postings as I’m a few months behind…