I’ve been farting around without any “real” financial goals for two years now.

I’ve been farting around without any “real” financial goals for two years now.

As a result, my finances have been, well, farting around. They’re okay, sure, but I’m not moving in any kind of direction. Just kinda treading water.

In 2007 and 2008, I was on a mission to eliminate my thousands upon thousands of dollars of car and credit card debt and I did it…quickly. Total success. Cheers all around.

In 2009, though, I got sloppy and set goals having to do with imaginary numbers from dream land. Save for “this” and “that” which don’t have pricetags attached to them. There wasn’t anything concrete.

It’s like the, “I’m saving for college” line you hear so often. I always want to follow-up and ask, “Any idea how much you need to save?” knowing full well that what they’re saving will barely put a dent in what they’ll actually need to spend.

Sorry, a few hundred dollars tossed into a 529 plan each year won’t add up to anything.

In 2010, I started to paydown all of my new found debt resulting from “this” and “that” which I didn’t save enough for in the previous year but I never really got serious about it.

Sure, the balances were falling all year long but it was a lot like a 529 plan — my payments weren’t getting me very far.

I could have done better. I should have done better.

I should be debt free again already…but I’m not.

I’ve been like a broken record player for two years now. It’s time to replace the needle.

(Where would one but a new needle in 2012?)

My goal for 2012 is simple — to be debt free and able to realisitically convince my wife that we *need* and can afford a third smurfling.

Here’s how I’m going to do it:

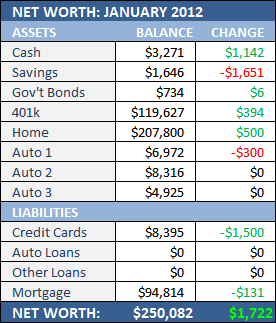

- Weekly $300 Auto-Payments – I’ve been doing this for months now and it’s what’s always driven all of my debt paydown efforts in the past. This is nothing new.

- End-of-Month Lump Sum Payments – This is what went by the wayside after I first cleared all of my debt. On the last business day of each month, I used to make as large a payment as I could afford so as to “pad” the numbers reported each month in my net worth updates.

The second bullet point is key to the success of the plan — I must-must-must start doing this again.

This site (the net worth updates) held me accountable to myself and even motivated me as I saw progress, real progress, each and every month.

Once I achieved my original goal of becoming debt free, well, that kinda stopped.

As for the third smurfling side of things, having kids has certainly forced me to cut my out-of-wallet spur of the moment spending drastically.

Before we had kids I used to hear people talk about how much formula costs, and doctor visits, and clothing, and this-and-that relating to having kids.

I haven’t found those things to be terribly hampering — it’s the daycare costs that kill you financially.

Did you know that we pay four times our mortgage payment for daycare?

That’s the crippling part. And it’s also the part that has us on the fence about a third.

Can we afford it?

Right now, the answer is no.

But when you take out the $1300 I’m autopaying to the credit cards to get out of debt each month, the answer leans more towards yes.

Can we get a new kitchen too?

Well, I wish but that puts us back to no.

And while I’d really like a new kitchen to match the rest of the renovation, when I look at my two angry birds, I know without a doubt that they’re the best thing I’ve ever done and they’re the best thing I’ll ever have.

So much more rewarding than a new kitchen.

So I’m getting greedy — I want another.

I just have to get my finances in order pronto.

And then we’ll start “saving” for that kitchen without a “pricetag”.

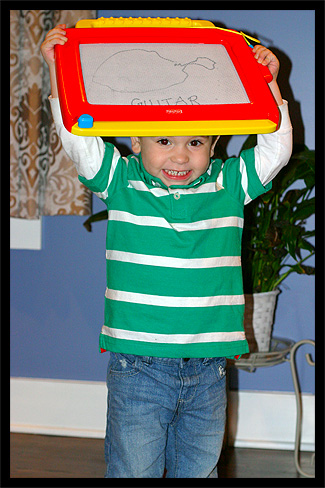

I can’t tell you how awesome it is that Duncan can now draw something totally recognizable.

I can’t tell you how awesome it is that Duncan can now draw something totally recognizable.

As a professional

As a professional  Sure, I could look this up but my first thought was to ask frequent contributor DD (the inspiration for my

Sure, I could look this up but my first thought was to ask frequent contributor DD (the inspiration for my  While perusing through the archives of this site, I’ve found that my posts used to be, well, more frequent, yes, but better too.

While perusing through the archives of this site, I’ve found that my posts used to be, well, more frequent, yes, but better too. As with

As with

Starting the new year off right with a net worth just north of $250k.

Starting the new year off right with a net worth just north of $250k. I’ve been farting around without any “real” financial goals for two years now.

I’ve been farting around without any “real” financial goals for two years now.