So today, as I took on the role of Mr. Mom (daycare is closed today), Duncan came to me and asked to do another guest post.

So today, as I took on the role of Mr. Mom (daycare is closed today), Duncan came to me and asked to do another guest post.

His first post was a bit cryptic but, to his credit, he *was* only 5 days old.

Then, a month later, when I was practically in full Mommy-blog mode, he did a guest video post.

At the time it was pretty exciting.

Now, though, it’s pretty, well, it’s just another “baby babbling” video on YouTube. You know what I’m sayin’…

For his third post, though, now nearly 18 months later, having grown tired of being seen here on PIAC but not heard, he wanted to do something different and show off his speaking voice and newly discovered command of the English language.

Here’s his 17-second podcast:

Okay. I’ll admit he doesn’t speak much English… but he speaks a mean Tiger, dontcha think?

Okay. I’ll admit he doesn’t speak much English… but he speaks a mean Tiger, dontcha think?

And, sorry if this ruins the whole Brainy Smurf image for you. I sound nothing like him — I’m actually frequently told that my speaking voice (when recorded) resembles Kermit the Frog.

I don’t hear it, personally.

Maybe it’s a bad Steve Whitmire version of Kermit but certainly nothing like the original Jim Henson Kermit…

Anyway, the real reason for this post is because I’ve recently found out that a lot of people in my “close” family have been following Duncan’s, well, life through this website.

Anyway, the real reason for this post is because I’ve recently found out that a lot of people in my “close” family have been following Duncan’s, well, life through this website.

There are even a few unrelated readers that only seem to enjoy the Duncan photos that I randomly include in my postings — they’ve emailed me saying just that.

So I figured that I’d take it a step further and let you all hear him too (while making great use of the digital audio recorder that Santa brought me).

No worries — I don’t expect to make a habit of this but…Duncan’s time in the spotlight is waning as Smurfling #2 rapidly approaches so enjoy it while it lasts!

Raaarrrr!!!

Another expensive month in the books to close out the year.

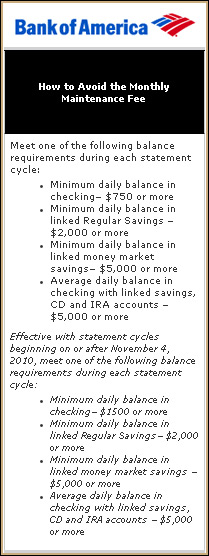

Another expensive month in the books to close out the year. So while reconciling my numbers last night I noticed that my BoA checking account balance was off by $14.00.

So while reconciling my numbers last night I noticed that my BoA checking account balance was off by $14.00. Christmas, like all of the big holidays for a lot of people, is all about family.

Christmas, like all of the big holidays for a lot of people, is all about family. Just days after paying my second installment of property taxes, I received a letter from the local tax assessor’s office.

Just days after paying my second installment of property taxes, I received a letter from the local tax assessor’s office. Well, it wasn’t as opulent as

Well, it wasn’t as opulent as  Years ago I lined myself up quite nicely without even realizing it. Though I only carry one credit card in my wallet these days, I currently have four of them in my arsenal.

Years ago I lined myself up quite nicely without even realizing it. Though I only carry one credit card in my wallet these days, I currently have four of them in my arsenal. How it ended up being a positive month is truly a mystery.

How it ended up being a positive month is truly a mystery.