The whole story begins way back in in October of last year when I went to the mall and picked up three new pairs of jeans.

The whole story begins way back in in October of last year when I went to the mall and picked up three new pairs of jeans.

Though I settled on Levi’s on that specific trip, the Gap has historically manufactured my favorite and best fitting jeans.

The Gap discontinued my “style” years ago but I still pop in everytime I visit the mall just to check and see if they’ve made a comeback. So far, no luck on that front.

But I did notice a jacket that I liked. I picked it up. I looked at it. I walked away. I walked back. I picked it up again. Basically, I did everything but try it on.

The price was $129.50.

Too much, I told myself.

I didn’t like it *that* much…

Then, a few weeks ago, I happened to open one of those “junk” emails that I get every so often from the Gap. It was advertising something that I had no interest in but it succeeded in getting my to visit their website.

That’s a win for them…

So, anyway, I see the jacket that I liked months earlier in the “Sale” section for only $69.99 (apparently down from $98).

I thought about it, oh, for maybe 45 seconds, and then I bought it.

Around a week later it arrived in the mail — I tried it on — and it was one of those fat guy in a little coat scenes.

I’d ordered size large.

Now, I know that pretty much none of you out there reading this know how big I am (three apples high — read the about section, will ya?) but in the grand scheme of things, I’d say that I’m a medium sized person.

I’m not small.

And I’m certainly not large either.

But a large-sized jacket from the Gap, well, let’s just say that they’re stuff isn’t exactly “true” to size. It never has been.

So we all piled into the car earlier this week to return it to our local Gap store.

When we entered the store, I saw that they too had the same jacket on a sale rack for — get this — $29.97.

Even better, they had an extra large available (which wasn’t available online).

Oh man…

I was like, uh-oh, what do we do?

I want to exchange this one for that one but I paid over twice as much for the one in the bag.

This would have to be a two step process — I was going to return this one, get the credit, then come back in later and buy the other one for less than half the price.

Yep, that was the plan.

My wife thought I was crazy — just make the return and buy the bigger one all in one shot, she said…

I wanted to play it cool, though, so I made it as if I hadn’t even noticed that they had the exact same jacket on sale for half the price and sauntered up to the counter to make the return.

After punching in a few buttons and scanning my receipt, Warren, if that was indeed his “real” name, lisped out that my account had been credited $74.19 (including the tax) and my wife, Duncan, and I made a hasty exit.

We walked around the mall for around a half hour and then my wife — now acting as a secret agent — went in to the purchase the jacket again in the larger size.

“Warren” was sharper than I’d expected. He was on to our scheme and made it *very* clear to my wife that this one was NOT returnable. He even used a highlighter (pink, of course) to make it overly clear on the receipt.

Doesn’t matter, though — this one fits.

Now I know we didn’t do anything wrong — it was all totally legit — but it still felt sneaky.

I mean, I went in to return a jacket and walked back out with the same jacket and nearly $45.

I dunno, it was very satisfying but felt wrong at the same time…know what I mean?

All told, though, by not buying the jacket back in October, I saved just short of $100…and that doesn’t happen very often…unless you’re a tiny size and gravitate towards ugly colours that you can regularly find on any clearance rack anyway…

When it comes to my finances, I like to think that I tend to

When it comes to my finances, I like to think that I tend to  Okay — so it seems that inactivity has reared its ugly head. I had two plastic casualties since

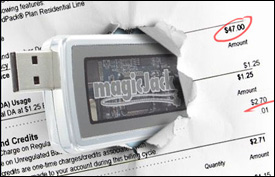

Okay — so it seems that inactivity has reared its ugly head. I had two plastic casualties since  This morning I just paid what I’m hoping was my last outrageously overpriced AT&T phone bill.

This morning I just paid what I’m hoping was my last outrageously overpriced AT&T phone bill.  The “event” didn’t sneak up on me.

The “event” didn’t sneak up on me. Deep breaths…

Deep breaths… On Saturday morning, we loaded into the car and headed to our local post office to get

On Saturday morning, we loaded into the car and headed to our local post office to get  A day late and a dollar short…

A day late and a dollar short…