That’s been my experience, anyway…

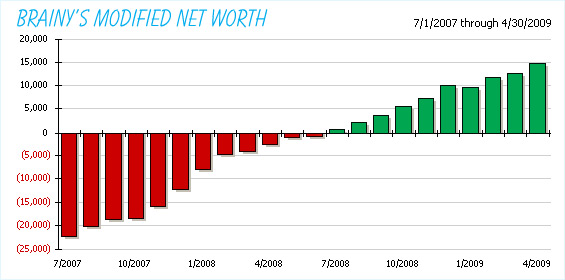

The following is a modified net worth chart that only includes my checking account, my savings accounts, my credit cards, my auto loans, and any other debts that I’ve carried besides the mortgage dating back to July 1, 2007.

Really, this is my “actual” net worth not including all of the stuff that I have little or no control over.

The 401k isn’t included, the equity in the house isn’t included, the value of my cars aren’t included — I’m not even including the value of my private plane!

In essence, if I had to get my hands on some money on a moment’s notice, this is what I have to draw from.

So, at the end of July in 2007, I was around $22k in the red and it took me 12 months to break out of the red in July of 2008 when I finally had more available in my “pocket” than I owed on my debts.

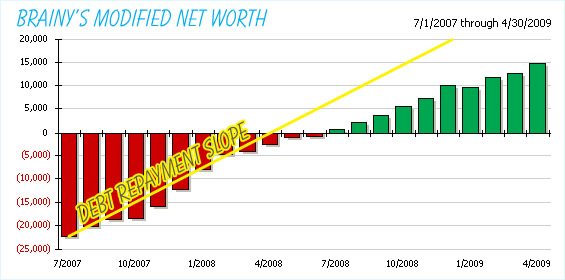

Twelve months to erase $22k in debt is pretty impressive.

That’s averaging over $1800 per month.

But that number is slightly skewed as I barely made any progress for three or four of those months so I’m going to go all 10th grade geometry on you and drop in a slope line.

See that?

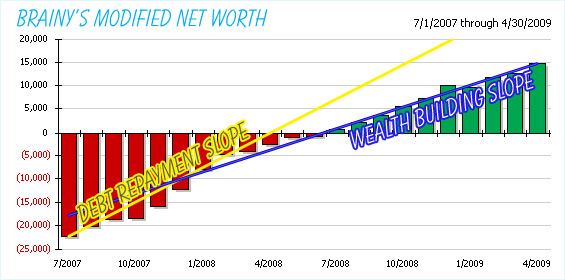

If everything had stayed on track after I broke out of the red, my wealth should be growing at an alarming rate.

I mean, it literally should have been “off the chart” back in December 2008.

That didn’t happen.

I continued on the right course, I just leveled off…

Take a look at the slope of my wealth building:

Sure, it’s still not bad but…it certainly isn’t “off the chart” either.

(By the way — these charts looked a lot cooler in my head… Hey, at least they’re better than the last time I worked slope into a post.)

So why is this?

I think it’s because I had a hard target to meet while paying down the debt. The goal was a balance of $0 and I did everything I could to hit that target.

Once the target was met, yeah, I tried to keep the ball rolling but I didn’t really have a set goal.

And I still don’t — and coming out and saying something like, “Yeah, I think I’m gonna shoot for $25k ASAP” just doesn’t work.

It’s too fuzzy.

Maybe that’s just me.

Anyway, I’m not really sure what to do about it (though tracking my expenses will surely help), I just thought it was interesting how my pace leveled off just as I found myself in the black (or green).

Coincidence?

I doubt it.

Last month

Last month  Every now and then while at work, I have to hop onto the internet to “look something up”.

Every now and then while at work, I have to hop onto the internet to “look something up”. I’m never really certain.

I’m never really certain.

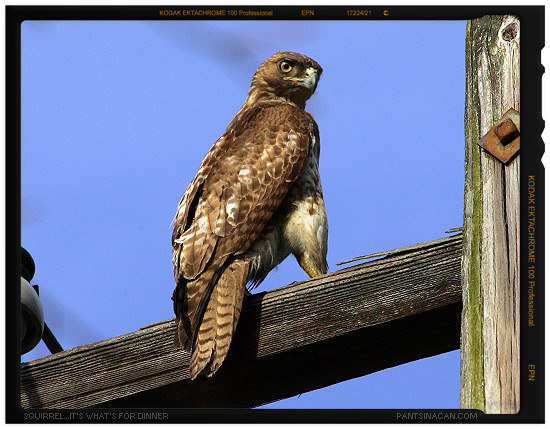

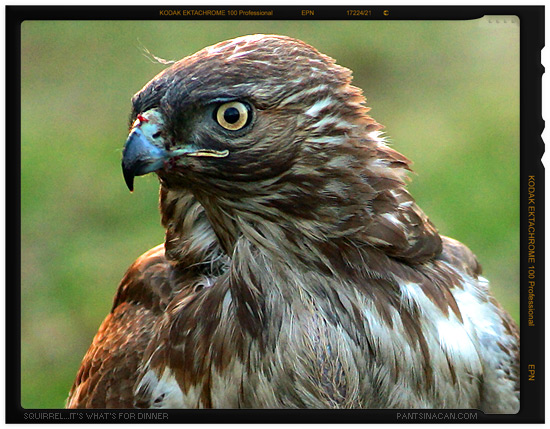

Another neighbor, joining the crowd (yeah, this is probably the most exciting thing to happen on our street in well over a year), thought it was a falcon.

Another neighbor, joining the crowd (yeah, this is probably the most exciting thing to happen on our street in well over a year), thought it was a falcon.

Way back in September, I mentioned that the

Way back in September, I mentioned that the  Wierd that it falls on April 15. Total coincidence, though…

Wierd that it falls on April 15. Total coincidence, though… As we’ve come to learn, when you’re

As we’ve come to learn, when you’re